Today’s fast-moving technology has made it easier and more convenient for providing consumer access to everything from depositing a check to applying for a home loan. Filling out forms, checking the boxes, and signing on the X can all be done online. Wet signatures are literally a thing of the past. Except for our government, most industries require everything to be completed online and submitted with the ease of an upload.

A broad definition of Fintech is the use of software to complete any type of financial transaction, using the internet, saving to the cloud, or accessing an app with your cell phone. Most of us use these tools every day, but we never imagined it being categorized under one umbrella called Fintech. So, where does the Fintech road take us from here?

Large investments in technology-based solutions have caused a leapfrog effect in banking and other financial services markets. At the onset of this Disruption, most of the solutions were created to streamline transactional-based payments, such as using a debit card versus writing a check. The next change about pop over the horizon is the disappearance of cash as payment for merchandise and services. Already present in the retail world are Zelle, PayPal, Venmo, GPay and Bitcoin. Online Banking and Bill Pay are now the most efficient and safe ways for businesses and consumers to exchange a service for a fee, and in real time. Digital payments are a requirement for Amazon, Walmart online, Alibaba and Flipkart. The software solutions these B2C companies use literally make these online giants some of the most powerful businesses in the world.

“The total transaction value of digital payments grew from $4.1 trillion in 2019 to $5.2 trillion in 2020. Digital payments are, without a doubt, the main driving force of the Fintech sector. With a 12.8% projected CAGR from 2019 to 2023, the total value of transactions is expected to reach $6.7 trillion by 2023.”

According to KPMG, investments and partnerships in Fintech solutions are what is fueling the success of B2B services to existing financial service businesses. Privately held companies, called “Unicorns,” are huge targets for venture capitalists. VCs are wining and dining these Fintechs who have earning potentials above $1 billion right out of the gate. The exchange of capital for financial services dominance is growing month by month. In February of this year, Fortune Magazine identified 30 “Decacorns” (companies valued over $10 billon), including SpaceX, Stripe, UiPath and Databricks. So, what does this mean for the mortgage industry?

5 Reasons why Mortgage Companies should be Disrupted by Fintech….

- Appraisal Software

2020 and 2021 have been changed forever by Covid-19. But, even prior to the pandemic, we saw the largest number of natural disasters in over a decade hit the US. It became literally impossible to have each home go through an onsite home inspection. Remote inspections became a normal process for evaluating the damage. Retrieving data from the homesite and getting it in the hands of appraisers was dependent upon software that’s robust enough to not only handle the number of claims but to streamline the process of mining the data to get accurate appraisals out to lenders and homeowners. On February 11, 2021, Texas was hit by an ice storm that wreaked havoc on the Dallas area, like no others had ever done in the past. Residents were without water due to frozen pipes, roofs caved due to the weight of the ice and houses flooded causing thousands to be dislocated. Power outages alone displaced nearly 2 million homeowners. Insurance companies counted on the reliability of desktop evaluation software to go through the claims as quickly as possible. Although there is still room for improvement, the impact of the software is powerful. When its humanly impossible to conduct an onsite appraisal without impacting those forced out of their homes, its evident that this software is destined to take a larger technology leap forward.

- Online Home Lending Platforms

Ads boasting “Pre-Approval in as little as 3 minutes, lock your rate in real-time, and bring a fraction of the traditional costs to the closing table,” are very powerful. Millennials and the Zoomers (post-Millennials) have been conditioned to “Think Fintech” for the better portion of their lives. Going back to the traditional loan application would be disruptive to this generation of homebuyers.

Over the past 5 years, online lenders have managed to capture 43% of the once-traditional lending process, moving aggressively from its 5% spot in 2015. This growth has prompted the Federal Reserve to establish a multi-disciplinary working group assigned to conduct a 360-degree analysis of Fintech innovation.

“While the growth of non-bank lending may raise some regulatory concerns, the firms’ technology platforms and their ability to use nontraditional alternative information sources to collect soft information about creditworthiness may provide significant value to consumers and small business owners, especially for those with little or no credit history. In addition, as more millennials make up the pool of small business owners and the consumer population, they are more comfortable with technology and therefore, may be more comfortable dealing with an online lender than in dealing with a traditional bank.”

While the Federal Reserve has retained the right to be skeptical, the expansion of online home lending is eminent. Digital engagement is here to stay.

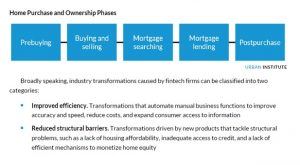

In the never-ending race for technology to dominate the mortgage space, we cannot overlook the complex and time-consuming process of the buyer experience. The Urban Institute, Housing Finance Policy Center breaks the mortgage lending buyers’ experience into five phases.

Some of the concerns Fintech technology is not able to address are building credit for a down payment and online mortgage counseling. By removing the face-to-face experience for borrowers, do lenders lose the borrowers with little to no experience, those who require hand-holding to become first-time homebuyers? Researching 2020 and 2021 buying numbers could reveal that Covid alone has had a dismal effect on those who need access to more information and data that software may not address.

- Centralized Underwriting and Processing Systems

Even GSE’s like Fannie and Freddie have their eyes set on technology to streamline all their processes.

“At Freddie Mac, we’re leveraging data analytics so our clients can more fully-digitize application processing, speed up underwriting and bring borrowers to the closing table sooner. “

In the traditional underwriting world, underwriting experts review applications to assess the risk a lender might inherit if approving the loan. Many factors play into the risks of a lender losing its investment. Factors include Ability to Repay, Income and asset verification, Credit Profiles, Proof of Earnest Money, Home Valuation, and Verification of Identity. Traditional Underwriting takes anywhere from a few days to a few weeks depending on the complexity of the loan and the borrower’s outcome.

The process intensity is further hampered by missing documents, credit checks that are less than stellar, missing title docs, liens and a myriad of other documents that aid in minimizing lender risk.

Freddie Mac loans are now more efficiently qualified by using proprietary Fintech tools like AIM, that automate the borrower assessment for lenders. AIM includes third-party service providers tied to the backend that seamlessly deliver pieces of the underwriting process. AIM’s main job is to get its borrowers to the closing table faster while providing a streamlined assessment to identify risks.

- Closings

Over the past 18 months, the world has been more affected by the need for isolation than ever before in history. COVID-19, as bad as it is, has caused technologists to look for innovation that meets regulators’ requirements while ensuring no one gets exposed to the virus. What a challenge!

In the most regulated industry of all, financial services have not only been forced to automate processes but do so immediately. In mortgage lending, COVID 19 may be the industry’s biggest “Disrupter.” Where technology has been evolving for quicker, better, and more accurate processes, COVID-19 has hit us like a bolt of lightning. We couldn’t plan for it, use our secret weapons to battle it, or win the war back to normalcy without technology.

“We’re creating a program on our end for customers to go online and understand everything about their loan and what’s going on. It’s a new time for our industry, with so much going virtual,” says Diane Tome, Chief Executive Officer of the American Land and Title Association.

Industry leaders worked together with regulators to come up with solutions that could still get buyers to the closing table without the risk of contracting the virus. Technology needed to step up to the plate and support the process…and they did. Things like remote notary, electronic transactions, and deploying integration tools that support digital loan closings all came together. The processes had to be succinct and acceptable practices by the regulators. And, the win-win for all is the environmental impact technology is having on the industry.

“Just by doing business online, and using remote notarizing, we’ve seen closing times decrease from an average of 60 minutes to 20 minutes,” Aaron Davis, chief executive officer of Florida Agency Network. “I think we might be the largest killers of trees in the country, with all the paper we have to print, have signed, and have to file. No paper or printing is a huge cost saver.”

- Post-Purchase Services

One would think that the mortgage loan experience ends at the closing table, but today’s Fintech tools have taken us one step further. After-the-sale products like home improvement, home equity lending, home appliance warranties, and home insurance all happen after the fact.

This is a segment of the market that has yet to be saturated by Fintech products. Just imagine all the third-party vendors that could be tied to the backend of Post-Purchase software. One post-purchase vendor relies heavily on the needs of seniors by providing installation of shower grab bars, wheelchair ramps, improved accessibility and customized features like wider door openings. These types of vendors can be hard for homebuyers to identify resources. Long wait times and the fear of getting a bad contractor lurk in the minds of anyone needing to contract for services.

As hard as it is to believe, Fintech has a lot of room for growth. There are multiple opportunities to streamline and transform the mortgage process and improve the buyer experience. With less than 50% of the mortgage market “gone Fintech,” the other 50+% is up for grabs. If Fintech is not disrupting your business, it may be time to make that happen.